Update Thursday at 11 pm:

The deal finally got done. Late Thursday night The Walt Disney Company announced the sale of MIramax to a consortium led by L.A. billionaire Ron Tutor.

(Also read: The Real Miramax Price: $600 Million)

"The Walt Disney Company announced today the sale of Miramax Films to Filmyard Holdings LLC for over $660 million subject to certain adjustments. Partners in Filmyard include Los Angeles businessmen Ron Tutor, Tom Barrack, Colony Capital LLC and other individuals. The transaction is subject to certain regulatory approvals and is expected to close between September 10, 2010, and the end of the calendar y ear," the announcement said.

ear," the announcement said.

The sale came almost 24 hours after the supposed final deadline for negotiating the deal, and one day after Disney spent close to the same sum it made on Miramax — $563 million — for social media gaming developer Playdom.

(See related story: What's Behind Disney's Social-Media Land-Grab)

The Miramax deal has been the subject of a protracted bidding process since January involving multiple billionaires and testy personalities. It includes the rights to more than 700 film titles, among them the Oscar winners "Chicago," "Shakespeare in Love" and "Pulp Fiction."

The news release did not specifically mention Morgan Creek or its CEO, Jim Robinson, who had been expected to be part of the investor group.

Also included in the sale are non-film assets, such as certain books, development projects and the cherished Miramax name, derived from Miriam and Max, the names of the parents of indie studio founders Harvey and Bob Weinstein.

"Although we are very proud of Miramax's many accomplishments, our current strategy for Walt Disney Studios is to focus on the development of great motion pictures under the Disney, Pixar and Marvel brands,” said Robert A. Iger, Disney’s president and CEO. “We are delighted that we have found a home for the Miramax brand and Miramax's very highly regarded motion picture library.”

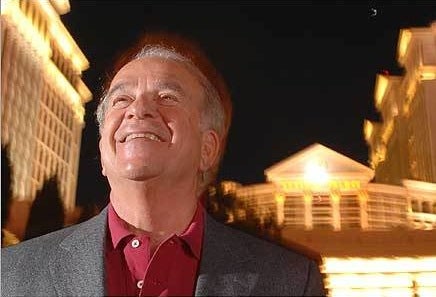

“I am delighted and honored to acquire the Miramax library,” said Ron Tutor. “On behalf of my partners Tom Barrack and Colony Capital, we look forward to sharing this high-quality content with the world in every form of media for many years to come.”

Previously:

Barring any unforeseen developments, L.A. billionaire Ronald Tutor will have his prized Miramax by the end of day on Wednesday, according to a knowledgeable individual.

The real-estate titan is close to wrapping up negotiations to buy Miramax from the Walt Disney Company, the individual said.

In addition to Tutor, the consortium of investors includes Morgan Creek and Colony Capital. The controversial film financier David Bergstein has been advising the group and was the architect of the deal.

For a sale price of $675 million, Tutor and his partners will get the premiere film library in Hollywood — 700 films including such contemporary classics as Oscar-winning "Pulp Fiction," "Shakespeare in Love," "My Left Foot" and "Good Will Hunting."

Individuals involved in the negotiations said Tutor had planned to put in $50 million, Colony $100 million and Morgan Creek's Jim Robinson $75 million in cash, with banks putting up debt equity for a significant portion. The indie division comes with about $50 million in cash on its books, so the sale is closer to the lower end of $600 million.

Disney did not respond to requests for comment.

Disney had sought a sale price of $700 million. Bidders — including financiers Tom and Alec Gores and an investment group led by billionaire Ron Burkle with Miramax founder Harvey Weinstein — fell out because they believed the price was too high.

Tutor will take the lead management position in the independent studio. He plans to run the company as a stand-alone studio. Morgan Creek will serve as a distribution partner for Miramax's films.

He is expected to hire a seasoned CEO to run the company and already has been scouring Hollywood for executive talent. But his focus, he has said, will be to maximize revenue out of the library, rather than focus on new production.

What role Bergstein will play remains unknown at this juncture. The former ThinkFilm head is being sued by creditors over millions of dollars in unpaid bills. Tutor has likewise been ensnared in his business partner's mounting legal troubles. Last week, a federal bankruptcy court judge ordered Tutor to give a deposition outlining his dealings with Bergstein at the end of this month.

After Disney accepted his bid for Miramax, Tutor began distancing himself from Bergstein. In an interview with the Hollywood Reporter he said the film financier would have no role in the company. He later backtracked from those statements, claiming he was misquoted.

In January, Disney shuttered Miramax's Los Angeles and New York offices and laid off most of the studio's staff. The arthouse division has effectively been put on ice until a sale went through.