If you subscribe to services such as Netflix and Hulu, you’re contributing directly to the boom in the over-the-top (OTT) TV service market. OTT TV services enable subscribers to stream TV content, without a set-top box, over the Internet.

If you subscribe to services such as Netflix and Hulu, you’re contributing directly to the boom in the over-the-top (OTT) TV service market. OTT TV services enable subscribers to stream TV content, without a set-top box, over the Internet.

Most of the money in the market comes from professional long-form content, which lasts at least 30 minutes, so this post focuses on only this type of video. (User-generated short-form content, with each episode lasting only a few minutes, does not generate nearly as much cash as its long-form counterpart.)

But exactly why are OTT TV services booming, and what are the economics that underlie this expansion?

The traditional TV ecosystem is relatively straightforward. Organizations (e.g., production houses, sports leagues) create and own the content, which they sell to aggregators (i.e., channels, broadcasters or cable networks), whose programming wheels contain a variety of content (note that many aggregators have their own captive studio). Aggregators have agreements with pay TV distributors (e.g., Comcast, Time Warner), which sell their TV packages to us, the consumers. In this ecosystem, TV packages are the only means by which consumers have access to all the channels.

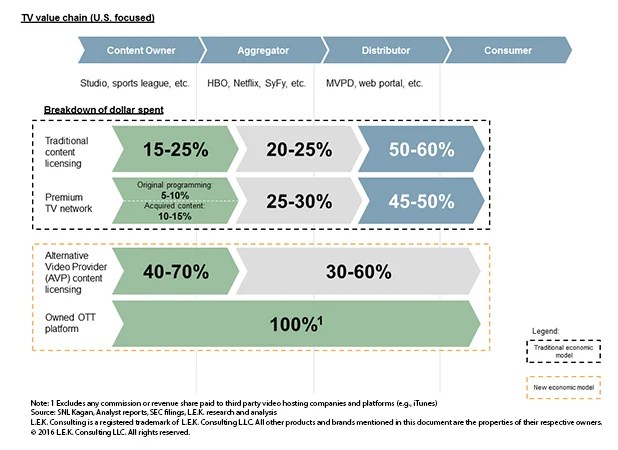

This chart illustrates this simple value chain:

Although this seems to be a formidable model, OTT platforms are disintermediating the traditional TV network value chain, bringing content owners and consumers closer, and forcing the traditional players to compete in different ways. In today’s ecosystem, everything is new: new content creators, new aggregators, new distributors, new ways for consumers to access an ever-expanding portfolio of content. The next chart shows four distinct ways to think about OTT distribution:

Although this seems to be a formidable model, OTT platforms are disintermediating the traditional TV network value chain, bringing content owners and consumers closer, and forcing the traditional players to compete in different ways. In today’s ecosystem, everything is new: new content creators, new aggregators, new distributors, new ways for consumers to access an ever-expanding portfolio of content. The next chart shows four distinct ways to think about OTT distribution:

- The pay-TV provider offers an OTT platform (e.g., Comcast offers Xfinity)

- The content owner offers an OTT platform, but the pay-TV provider authenticates subscriptions (e.g., HBO offers HBO GO, and Comcast authenticates HBO subscriptions)

- The OTT platform is offered directly to subscribers from the aggregator, separate from the traditional TV ecosystem (e.g., Hulu, which, in addition to being an aggregator, is an alternative video provider, or AVP)

- The OTT platform is offered directly to subscribers from the content owner, with absolutely no middleman (e.g., WWE)

As you can see in the graphic below, Hulu short-circuits the traditional system, bypassing traditional aggregators and distributors. And WWE has developed an OTT product that goes direct to consumers, bypassing all the normal steps.

Content owners, in particular, benefit from the development of OTT offerings. For example, they can establish relationships with consumers, obtain helpful feedback directly from consumers and wield greater control over how the content is shown and consumed.

Content owners, in particular, benefit from the development of OTT offerings. For example, they can establish relationships with consumers, obtain helpful feedback directly from consumers and wield greater control over how the content is shown and consumed.

But the main reason why content creators like OTT TV platforms is the literal bottom line: They share revenue dollars with fewer parties by going directly to consumers. In the traditional ecosystem, intermediaries take most of the revenue. In that value chain, distributors like Comcast take 50-60 percent of the consumer dollar, and aggregators like ABC take another 25-30 percent, leaving only 10-25 percent for content creators.

Thus, in the traditional ecosystem, content owners only capture a fraction of what the consumer ultimately pays for their content as aggregators, and distributors take most of the cut. In the new value chain, content owners can boost their cut from the traditional 15-25 percent all the way up to 100 percent by going direct.

Thus, in the traditional ecosystem, content owners only capture a fraction of what the consumer ultimately pays for their content as aggregators, and distributors take most of the cut. In the new value chain, content owners can boost their cut from the traditional 15-25 percent all the way up to 100 percent by going direct.

Although content owners that have their own OTT TV platforms collect more revenue, they encounter challenges, including customer acquisition/retention and technological innovation. Nonetheless, the industry is booming.

In our next post, we will discuss the formula for a winning OTT TV platform.

This is Part 1 in a series on over-the-top (OTT) trends by Dan Schechter, Gil Moran and Francesco Di Ianni from L.E.K. Consulting’s Media & Entertainment consulting practice.