CBS and Viacom have reached a “working” agreement on the management structure in the increasingly likely event the two companies complete their long-awaited merger.

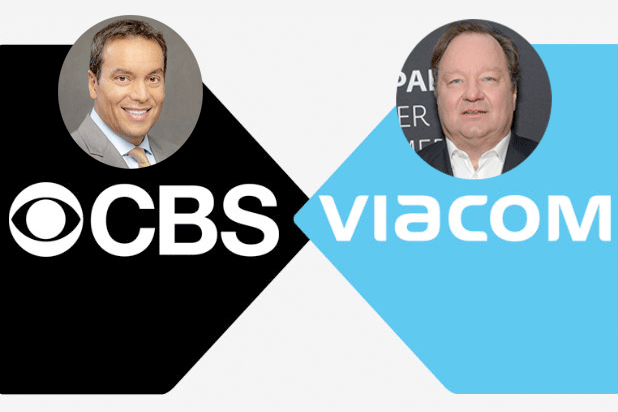

Viacom CEO Bob Bakish would take over as CEO of the newly combined company while Joe Ianniello, who has served as acting CEO for CBS since Les Moonves’ ouster last September, would be offered an unspecified senior role overseeing brand assets, an individual familiar with the companies told TheWrap.

CBS and Viacom both declined to comment. The Wall Street Journal, which first reported the news on Friday, added that a deal could be reached by the end of this month.

In addition to ironing out the two key roles, the Journal reported that CBS and Viacom have agreed that CBS Chief Financial Officer Christina Spade would become CFO for the combined company. It’s unclear whether Viacom CFO Wade Davis, who serves in a much broader role, would decide to stick around in the combined company.

However, no formal offer has been made by CBS to acquire Viacom. Both companies are set to report second-quarter earnings next week, and Wall Street is sure to be looking for insight into what to expect in terms of the long-anticipated merger.

When CBS extended an offer to buy out Viacom in April 2018 — below Viacom’s market value — who would sit at the top of the combined company was one of the major sticking points.

That dispute led to a nasty tug-of-war between Shari Redstone, who owns roughly 80% of both CBS and Viacom through her family holding company, National Amusements, and then-CBS CEO Les Moonves, who wanted Ianiello positioned as his heir apparent within the combined company.

After a lengthy public spat between the two, Moonves was eventually forced to step down following multiple accusations of sexual assault and harassment against him, which is when Ianiello took over as acting CEO.

Shares in Viacom, with a market cap of $12.2 billion, closed at $34.59 on Friday before the Journal’s story broke. Shares in CBS, which is valued at $18.9 billion, closed at $50.40.

A merger would represent a homecoming since the two companies operated as one until being split off in 2005.