As CBS Corp. and former sister company Viacom Inc. rekindle talks of a long-anticipated merger, a potential deal could look very different than a year ago, when both sites walked away from the negotiating table amid a legal tug of war.

“Viacom is in a much better position since last time. They’ve shown the revitalization is gaining traction,” CFRA Research analyst Tuna Amobi told TheWrap. “Their leverage is better than last time.”

Viacom, which owns MTV, Comedy Central, Nickelodeon and Paramount Pictures, has taken significant and noticeable steps to better position itself both in the industry, where cable TV channels have become less popular, and in negotiations with CBS. Viacom earlier this year bought the ad-supported free streaming service Pluto TV, which has shown early success with monthly active users increasing 31% since December and reaching 16 million users in April.

In another sign of increasing profitability, Viacom over the past two quarters also has reported year-over-year growth and exceeded forecasts for earnings-per-share, though Viacom shares are down 65% percent over the past five years. And in its most recent quarterly earnings report, the company said that Paramount Pictures had its ninth straight quarter of year-over-year growth in adjusted operating income.

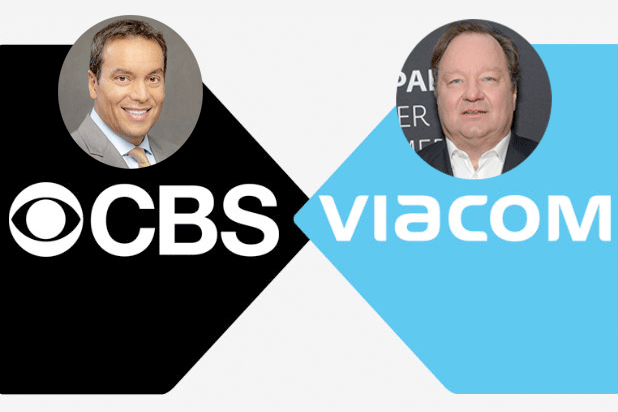

CBS declined to comment and a spokesperson for Viacom did not respond to request for comment; however, Viacom CEO Bob Bakish, who took over in October 2016, spoke about the company’s turnaround during an event at the Paley Center last week in Los Angeles.

“We really have not only stabilized, but revitalized the company,” Bakish said at the event. “We’ll see what happens, but the opportunity that’s afforded in today’s landscape continues to be very good for Viacom.”

Since last summer, when Viacom and CBS were last in the thick of negotiations, Disney bulked up through its $71.3 billion deal for Fox’s film and TV entertainment assets and WarnerMedia became a media powerhouse through the AT&T acquisition of Time Warner. Those deals have since changed the face of the industry and are likely the impetus for accelerating Viacom and CBS merger talks, according to analysts.

With renewed merger discussions, streaming could likely be a much bigger consideration this time around, Amobi said, as CBS has experienced success with its Showtime and CBS All Access streaming platforms.

“I would still argue that Viacom still needs this a little bit more,” Amobi said. “You could argue that they could wait a few more years and prove out their turnaround and the Pluto acquisition. That could all happen, but it could also not happen. Now would be the perfect time.”

Shari Redstone, who oversees controlling stakes in CBS and Viacom through her family holding company National Amusements, began pushing for a merger in 2016, following the ouster of then-Viacom CEO Philippe Dauman. The move was seen as a way to help stabilize Viacom’s struggling business: Ratings at its flagship networks were in the gutter and Paramount Pictures was losing money hand over fist.

In addition to helping shelter Viacom from an increasingly competitive landscape, the merger was thought to help provide scale to CBS and unearth value for shareholders.

Merger talks have since fallen through again and again, with the last discussions between CBS and Restone’s National Amusements resulting in settlement preventing National Amusements from pursuing a merger between CBS and Viacom for two years. The CBS board is said to have initiated the latest round of talks.

Bakish has kept his head down and worked to turn Viacom and its businesses around.

“This is the third time we’re having conversations about this,” Bakish said at the Paley Center last week. “Our focus the first time was, just stay focused and run the business.’ Second time, same thing. Third time, same thing. And because of that, the company is in materially better shape from the second time to the first time and from the third time to the second time. So we’re feeling great, we’re staying focused.”

In April 2018 — in the weeks after CBS made a below-market-value offer to buyout Viacom — Viacom reported that Paramount had returned to profitability after having lost $500 million in the previous year.

“The movie business is hit-and-miss — past performance doesn’t guarantee future outcomes,” said Ross Gerber, CEO of media investment firm Gerber Kawasaki. “The way I see the world, CBS doesn’t need Viacom.”

As for CBS, it was viewed 12 months ago that a merger with Viacom would be a drag on the company and its shareholders — until CEO Les Moonves was ousted following multiple accusations of sexual assault and harassment against him. Subsequent reports revealed a culture of toxicity.

Now, with several new board members in place, CBS is faced with the problem of an uncertain leadership future. Despite interim CEO Joe Ianniello receiving a six-month extension in April, his close ties to Moonves and the previous regime have been seen as a concern. A merger could fix that.

Redstone and Viacom expressed in April 2018 a desire that Bakish and his management team take over the reins at the possible combined company. Experts see that as the likely outcome in a deal that seems all but inevitable.

The only question will be the price and how the deal is structured. Needham analyst Laura Martin said CBS would likely want to own 60 percent of the new company, even if Viacom ultimately runs most of the operating business.

“They’ll both win if they get together,” Martin said. “They’re going to get it done. Though, you could argue they’re still not big enough together.”