After years of starts and stops, CBS and Viacom are finally getting back together. The two companies announced their long-awaited merger on Tuesday

The two companies agreed to an all-stock deal that valued Viacom at roughly $12 billion. CBS shareholders will own approximately 61% and Viacom shareholders will own approximately 39% of the new company, which is named ViacomCBS. In making the announcement, ViacomCBS touted an annual revenue of $28 billion.

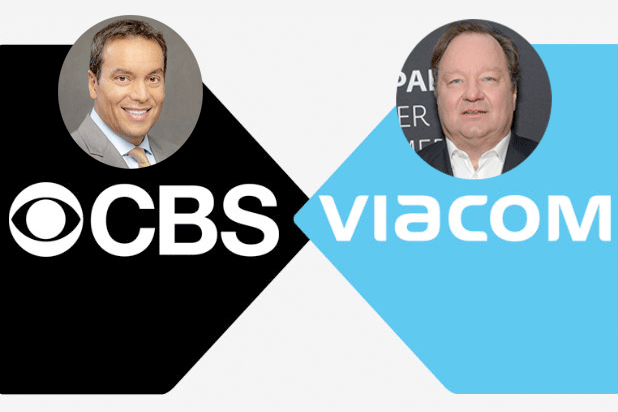

Viacom CEO Bob Bakish, as expected, will lead the newly combined company as president and CEO, with Joe Ianniello named chairman and CEO of CBS, putting him in charge of all CBS-branded assets. Ianniello has been serving as acting president and CEO since last September, following the resignation of Leslie Moonves. This means that other CBS Corp assets including pay cable network Showtime, Pop TV and publisher Simon & Schuster are now under Bakish, with CBS chief creative officer David Nevins — who also CEO and chairman of Showtime — will report to both Ianniello and Bakish.

Additionally, Christina Spade will be CFO of the company — Viacom CFO Wade Davis will depart once the deal closes — and Christa D’Alimonte will serve as general counsel and secretary.

Shari Redstone, president of National Amusements Inc., which is the controlling stakeholder for both companies, will serve as chairman of the board of ViacomCBS. The 13-person board will consist of six members from CBS board, four from Viacom and two from National Amusements. Bakish, as CEO of ViacomCBS, will be on the board as well.

CBS and Viacom executives will hold a conference call at 1:30 p.m. PT.

“Today marks an important day for CBS and Viacom, as we unite our complementary assets and capabilities and become one of only a few companies with the breadth and depth of content and reach to shape the future of our industry,” Bakish said. “Our unique ability to produce premium and popular content for global audiences at scale -for our own platforms and for our partners around the world -will enable us to maximize our business for today, while positioning us to lead for years to come. As we look to the future, I couldn’t be more excited about the opportunities ahead for the combined company and all of our stakeholders -including consumers, the creative community, commercial partners, employees and, of course, our shareholders.”

The deal puts the CBS broadcast network, Viacom’s stable of cable channels like MTV and Nickelodeon, and the Paramount film and TV studio under one roof. The transaction is subject to regulatory approvals and other customary closing conditions. It is expected to close by the end of this year.

Ianniello added: “This merger brings an exciting new set of opportunities to both companies. At CBS, we have outstanding momentum right now -creatively and operationally -and Viacom’s portfolio will help accelerate that progress. I look forward to all we will do together as we build on our ongoing success. And personally, I am pleased to remain focused on CBS’s top priority -continuing our transformation into a global, multiplatform, premium content company.”

The now-CEO of CBS added in an internal memo: “It’s important to note that the vast majority of you will continue to excel in your current roles. And while all of us will experience some change, including new challenges and opportunities, I want you to know that each and every one of you is a crucial component of our success, and we value your contributions every day.”

The combined entity is projecting $500 million in synergy savings within two years through the elimination of overlapping corporate operations and other savings.

It’s been a long time coming for the two former-sister companies to get back together. The two companies split from each other in 2006.

CBS and Viacom walked away from a merger last year amid a legal tug of war between Moonves and Shari Redstone, who runs CBS’ controlling stakeholder National Amusements. Redstone has long had her eye on reuniting the two companies, but had received pushback over Viacom’s poor performance.

“I am really excited to see these two great companies come together so that they can realize the incredible power of their combined assets. My father once said ‘content is king,’ and never has that been more true than today,” Redstone said. “Through CBS and Viacom’s shared passion for premium content and innovation, we will establish a world-class, multiplatform media organization that is well-positioned for growth in a rapidly transforming industry. Led by a talented leadership team that is excited by the future, ViacomCBS’s success will be underpinned by a commitment to strong values and a culture that empowers our exceptional people at all levels of the organization.”

But the company is in a much better place this time around. Earlier this year Viacom bought the ad-supported free streaming service Pluto TV, which has shown early success with monthly active users increasing 50% since December and reaching 18 million users in August. During its third quarter earnings last week, Viacom saw domestic ad revenue grow (by 6%) for the first time in five years and said that its filmed entertainment group is on track to be profitable for the fiscal 2019 year.

The media industry is in a far different place since the last time CBS and Viacom were corporate siblings 13 years ago.

The industry has become all about scale. Disney finished off its $71.3 billion acquisition of Fox’s TV and film assets in March, and last year AT&T acquired Time Warner, and turned into WarnerMedia, aligning its entertainment assets — HBO, Turner, Warner Bros. — closer together.

Tech giants like Netflix and, to a lesser extent, Amazon, have upended the entertainment industry, luring in high priced talent and taking advantage of shifting consumer behavior that has moved away from live television. Within the next year, Disney, Apple, WarnerMedia and Comcast will launch their own direct-to-consumer offering in what figures to be an all-out land grab for consumer dollars.

CBS has two smaller streaming offerings in CBS All Access and Showtime, while Viacom has the free streaming app Pluto TV and the upcoming BET+. It remains to be seen if the new CBS-Viacom will pool its assets together, which includes film and TV studio Paramount, to launch a more comprehensive streaming competitor.