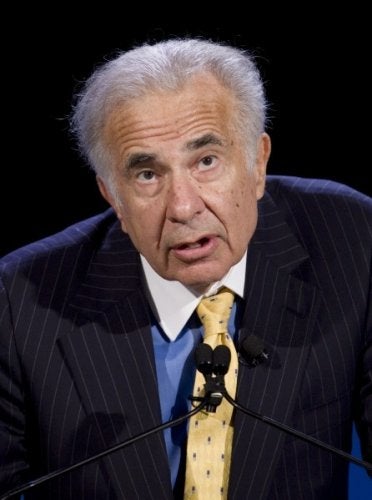

Activist investor Carl Icahn sent a letter to the board of directors of his latest takeover target, Lionsgate, on Friday, threatening to tip the company into bankruptcy if it didn’t go along with him.

Icahn, who holds 19 percent of Lionsgate’s outstanding shares and likely will be tendered another 5.4 percent by Mark Cuban and about 4 percent by individual investors, said he had enough shares to trigger "cross-defaults" on Lionsgate’s outstanding debt, which he put at "over $472 million of bond indebtedness."

Icahn, who holds 19 percent of Lionsgate’s outstanding shares and likely will be tendered another 5.4 percent by Mark Cuban and about 4 percent by individual investors, said he had enough shares to trigger "cross-defaults" on Lionsgate’s outstanding debt, which he put at "over $472 million of bond indebtedness."

Warning that Lionsgate may not have enough money to repay its debt all at once, Icahn said that could send the company into voluntary bankruptcy.

(Read also: Cuban, Icahn Play Cat and Mouse With Lionsgate)

Icahn’s current $7-per-share offer closes June 16. He said there was a two-week window following that date during which share tenders would be accepted.

Lionsgate issued a statement early Friday afternoon addressing Icahn’s letter. It said, "As disclosed in the Company’s Schedule 14D-9 filed with the SEC on June 4, 2010, Lionsgate has been in discussions with its lenders to seek a waiver or amendment to its credit facilities in order to prevent an event of default and is confident in its ability to obtain one in the near future if necessary. This will resolve an issue that Mr. Icahn is trying to create."

Icahn described himself as "truly mystified" by the directors’ actions and "confused as to why you refuse to deal with the ticking time bomb sitting in your debt documents."

He also is threatening to replace the board: "As a shareholder, I’m forced to ask how much longer this board of directors will allow the party in the management suite to continue. How long can management continue to claim ‘record performance’ while cash flow remains anemic and the stock price remains in decline? Since the board is clearly unwilling to tell the Emperor he wears no clothes, it is left up to the shareholders to take action."

Icahn reiterated that he stands ready to start talks with the board about a bridge credit facility. And he declared, again, "We will not sit idly by if you attempt to employ inappropriate defensive tactics."

Lionsgate’s statement addressed the question of the bridge facility: "While the Company continues to engage in discussions with its lenders, it will welcome the opportunity to review the actual terms of a proposed bridge facility from Mr. Icahn. Lionsgate formally requests that Mr. Icahn disclose those terms to the Company and to the public." (The company later Friday also released an upbeat statement about its 2010 fiscal year.)

The full text of Icahn’s letter, dated June 11, follows:

Dear Members of the Board:

As you know, the offer by my affiliates to purchase any and all of Lions Gate’s outstanding common shares for $7.00 in cash per share is expected to close next Wednesday, June 16th. As I have previously announced, we will not be extending the offer again. I am writing to express my grave concern as a shareholder – and, I believe, as a soon to be much larger shareholder – over your apparent ambivalence regarding Lions Gate’s fate. I am truly mystified by some of your actions – and your inaction – in the face of the abject failure of the current management team to deliver value to shareholders, and I fear for the future of our company.

As you have noted several times in communications to shareholders (which I believe were designed to frighten them into not tendering their shares into our offer), our purchase of only a small number of shares at the conclusion of the offer would constitute an "event of default" under Lions Gate’s credit facilities, which in turn could trigger "cross-defaults" with respect to over $472 million of bond indebtedness. In fact, our purchase of even the 3.7% of outstanding shares that were tendered into the offer and not withdrawn as of our last announcement would already be enough to trigger this domino effect which, unless your lenders were to waive these defaults, could lead to the ultimate implosion of the company. What I find to be the most egregious part of this problem is the fact that it was created entirely by you – had the board not agreed to these controversial "poison put" provisions in the first place, shareholders would not be in the dire situation in which we now find ourselves.

As you have also noted, there can be no assurance that your lenders will waive such defaults and they have thus far been unwilling to commit to do so. If these defaults were to be triggered and you are unable to obtain the necessary waivers or an alternative source of financing (a huge uncertainty, given the current state of the debt markets), Lions Gate’s assets may not be sufficient to repay this debt in full. Under such circumstances, Lions Gate may find it necessary to pursue a voluntary bankruptcy filing. In addition, under certain circumstances, lenders, bondholders or other creditors may file an involuntary petition for bankruptcy against Lions Gate. As one of the largest – and, I believe, soon to be the largest – shareholder of Lions Gate, I am extremely concerned about this possible eventuality and I would imagine that other shareholders are similarly afraid of having their equity wiped out. That being the case, I find it amazing – and a frightening dereliction of your fiduciary duties – that you have ignored our offers, made publicly on several occasions, to discuss with the board the terms of a possible bridge facility that we would be prepared to provide – without a commitment fee – as a preemptive measure in order to permit Lions Gate to refinance its debt in the event of any such defaults.

Even if your lenders were willing to waive any defaults or to amend the offensive provisions of your credit agreements (thus averting the "cross-default" scenario), there is still the real possibility that our purchase of shares in the offer could result in events of default under the company’s bond indentures, under which there is currently outstanding over $472 million of debt. Those agreements permit bondholders to require Lions Gate to repurchase their bonds at par – and in certain circumstances also to pay a "make whole premium" – in the event of a "change in control" (which is defined to include any person or group becoming the owner of more than 50% of Lions Gate’s outstanding shares). Again, the sting of this landmine buried in the company’s indentures is exacerbated by the knowledge that the board had it fully within its power to avoid this problem entirely – by not agreeing to these egregious provisions in the first instance.

Although we suspect that you will continue burying your heads in the sand with respect to this impending disaster, we advise you again that we stand ready to begin discussions with you immediately regarding the terms of a bridge facility. We expect that such bridge facility would be required to be repaid through a combination of new debt and the proceeds of the sale of Lions Gate equity through a rights offering in which all Lions Gate shareholders would be invited to participate, thus de-levering the company. As we have stated before, we would be willing to backstop any such rights offering. Rest assured that if our shares are devalued as a result of your inattention to this matter, we will seek to hold you personally responsible to the maximum extent permitted under applicable law.

I have given this matter a great deal of thought and I must confess that I remain confused as to why you refuse to deal with the ticking time bomb sitting in your debt documents. Is it possibly because you refuse to believe that the number of shares tendered in our offer will be large enough to cause a default? It seems to me that you refused to believe the British Columbia Securities Commission would strike down your poison pill, but you were wrong. It seems also that you refused to believe our acquisition of control of Lions Gate would be found by the Canadian government to be of net benefit to Canada, but you were wrong again. You have made much in your public disclosures of the fact that only under 4% of the outstanding shares have been tendered to us thusfar. As you are well aware, however, the final major condition to our offer – receipt of approval of our offer by the Minister of Canadian Heritage under the Investment Canada Act – was only recently satisfied. In addition, as you are also well aware, the bulk of shares are typically not tendered until the last day or two of an offer. These facts, combined with the fact that our offer expires on June 16th and there will be no further extensions, leads us to believe that a substantial number of shares will be tendered to us. Consistent with this view, we note the statement yesterday by Mark Cuban, the holder of 5.4% of Lions Gate’s outstanding shares, that he thinks he will tender his shares into our offer.

We also continue to be concerned that the board may engage in an inappropriate defensive acquisition or other transaction in an attempt either to thwart our offer or to dilute our position following the expiration of the offer. We will not sit idly by if you attempt to employ inappropriate defensive tactics. Given recent history, we are observing your actions with a microscope and will continue to do so. We will challenge any proposed transaction that we perceive to be abusive of shareholder rights or otherwise disadvantageous to Lions Gate, and will seek to hold the directors personally liable for any breach of your fiduciary duties or actions which oppress Lions Gate shareholders or serve simply to entrench yourselves. In addition, we will not hesitate to enforce our rights against any third party that attempts to tortiously interfere with our offer by entering into an inappropriate defensive transaction with Lions Gate. We believe that in these circumstances any transaction effected outside of the ordinary course of business should not be unilaterally decreed by the board but rather should be put to a vote of ALL shareholders.

Lions Gate’s statements on June 4th in response to our tender offer were completely disingenuous and convinced me further that the board has become dangerously detached from reality. In recommending that shareholders reject our offer, you stated that Lions Gate "continues to successfully execute its business strategy," implying that the company is on the right road to profitability. However, it seems to me more like Lions Gate is racing down the wrong road at breakneck speed towards a precipice. On February 4, 2010 (the last trading day prior to the first date in 2010 that we resumed purchasing Lions Gate common shares), the closing price of the company’s shares was $4.85 – this represents a decline of over 50% from where Lions Gate’s shares were trading five years ago. And how has the board held this management team accountable for presiding over a period during which the company’s share price has been cut in half? By lavishing them with exorbitant salaries, bonuses, options, perquisites and golden parachutes! By my estimation, top management was rewarded during this period of decline with total compensation valued at well over $50 million. As if that were not enough, the board also recently saw fit to further protect management by placing $16 million in a trust to fund severance obligations that would purportedly be due to them should their employment be terminated in connection with a change in control. What are your plans to protect the value of the shareholders’ equity in the event that the company is forced into bankruptcy as a result of the debt defaults discussed above?

In addition, the anecdotal evidence regarding the overspending in Lions Gate’s corporate suite is the stuff of legend. A cursory review of recent press reports yields many references to management’s lavish new offices, their huge salaries and more than a few mentions of the Bentley driven by CEO, Jon Feltheimer. Sadly, however, one is hard pressed to find the stories detailing how management is committed to increasing earnings per share by attempting to boost revenues and cut costs. Reported "general and administrative" expenses (which includes salary and overhead) increased from under $70 million for the fiscal year ended March 31, 2006 to over $180 in 2010. As a shareholder, I’m forced to ask how much longer this board of directors will allow the party in the management suite to continue. How long can management continue to claim "record performance" while cash flow remains anemic and the stock price remains in decline? Since the board is clearly unwilling to tell the Emperor he wears no clothes, it is left up to the shareholders to take action. We therefore intend to conduct a proxy solicitation to seek to replace the board with our nominees at the upcoming annual general meeting of shareholders. We are hopeful that a newly elected board will act expeditiously to replace management and hold the new team accountable for performance moving forward.

Sincerely yours,

CARL C. ICAHN